For assistance in completing this template, we recommend downloading the Financial Projections Template Guide in English or Espanol. If you want to change a formula, we strongly recommend that you save a copy of this spreadsheet under a different name before doing so.

Small business income and expense template code#

If changes are needed, the unlock code is "1234." Please use caution when unlocking the spreadsheets.

*NOTE: The cells with formulas in this workbook are locked. If your projections turn out to be too optimistic or too pessimistic, make the necessary adjustments to make them more accurate. Compare your projections to your actual financial statements on a regular basis to see how well your business is meeting your expectations. Once you complete your financial projections, don’t put them away and forget about them. So can business advisors such as SCORE mentors. An accountant with experience in your industry can be useful in fine-tuning your financial projections. Use the information you unearthed in researching your business plan, such as statistics from industry associations, data from government sources, and financials from similar businesses. To make yours as accurate as possible, do your homework and get help. Financial projections are always educated guesses.

Small business income and expense template how to#

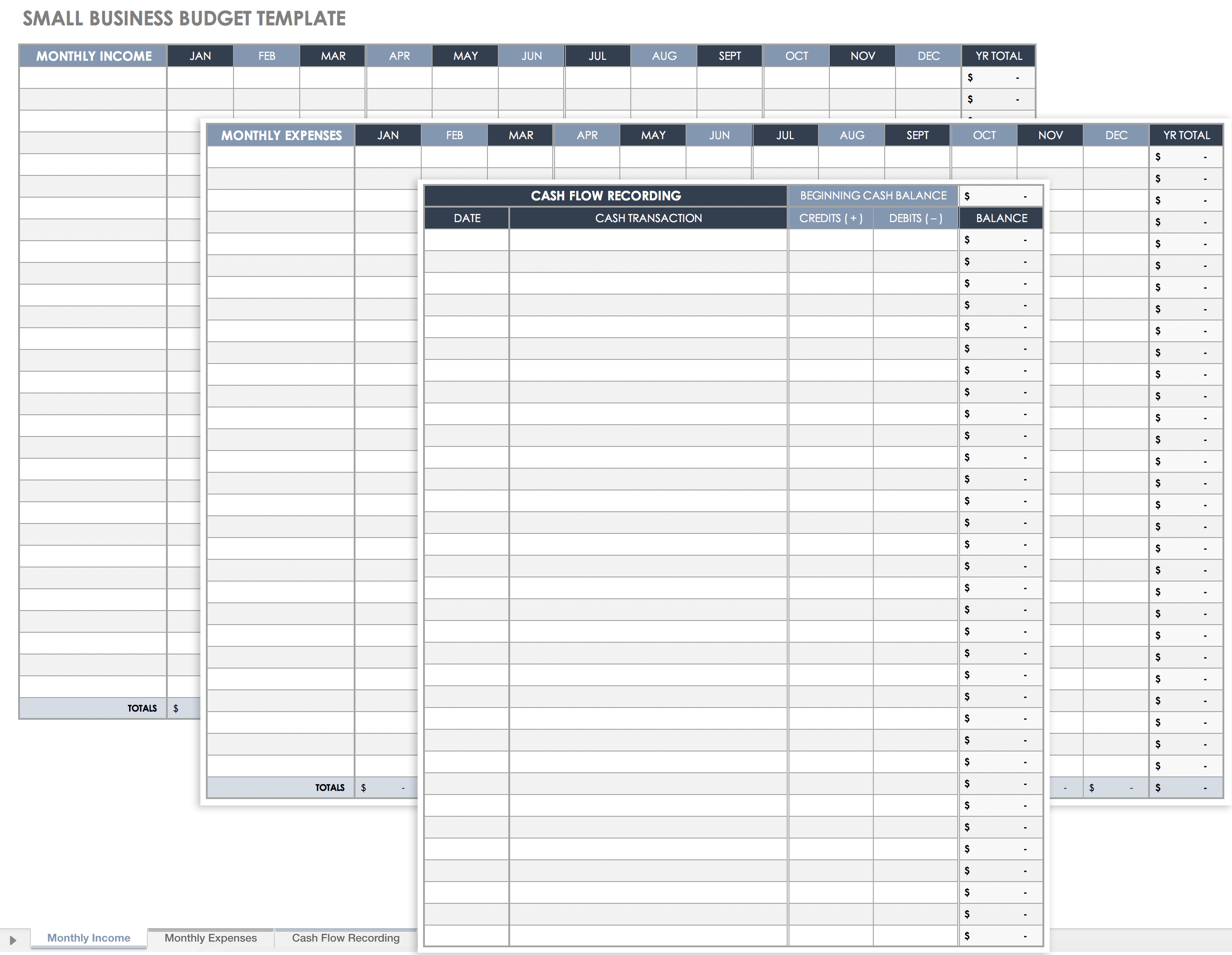

Startup business owners often wonder how to create financial projections for a business that doesn’t exist yet. Make sure you know the assumptions behind your financial projections and can explain them to others. You may want to include a best-case and worst-case scenario to account for all possibilities. The template also includes diagnostic tools you can use to test the numbers in your financial projections and make sure they are within reasonable ranges.Īll of these areas are closely related, so as you work on your financial projections, you’ll find that changes to one element affect the others. You can either use this template to create the documents from scratch or pull in information from documents you’ve already created. Amortization and depreciation for your business.Income statements for the first 3 years in business.Cash flow statements for the first 3 years in business.

Operating expenses for the first 3 years in business.This financial projections template pulls together several different financial documents, including: What’s Included in Financial Projections? When seeking outside financing, both startups and existing businesses will need financial projections to convince lenders and investors of the business’s growth potential.If you’re already in business, creating financial projections each year can help you set goals and stay on track.If you’re starting a business, financial projections help you plan your startup budget, assess when you can expect the business to become profitable, and set benchmarks for achieving financial goals.What Are Financial Projections Used for?įinancial projections are an important business planning tool for several reasons. If you need to create financial projections for a startup or existing business, this free, downloadable template includes all the tools you need.

They often include different scenarios so you can see how changes to one aspect of your finances (such as higher sales or lower operating expenses) might affect your profitability. Financial projections use existing or estimated financial data to forecast your business’s future income and expenses.

0 kommentar(er)

0 kommentar(er)